The PF calculator uses proprietary technology to fetch the correct sum every time you input data. KWSP dan Kumpulan Wang Lain Yang Diluluskan terhad RM6000 setahun termasuk premium insurans.

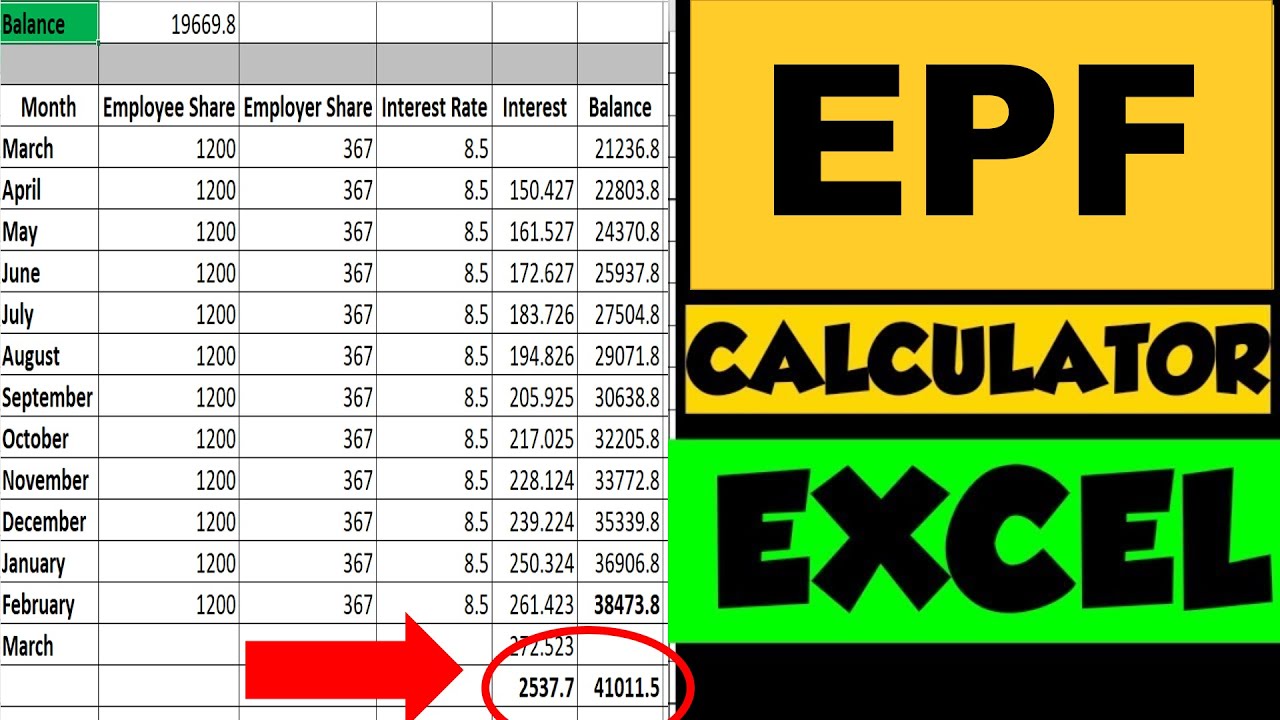

Download Employee Provident Fund Calculator Excel Template Exceldatapro

EPF SOCSO EIS PCB MTD Calculate your salary EPF PCB and other income tax amounts online with this free calculator.

. Then this year in February 2020 this rate was lowered to 7 for the period from April 1 to December 31 2020 as part of the Economic Stimulus Package. The Simple PCB Calculator is compatible in most popular browsers and mobile devices. Key in the Monthly Regular Contribution amount for your KWSPEPF account.

An EPF calculator can help you estimate your savings appropriately. It aims to be the minimalist alternative to the Official PCB calculator. The Employees Provident Fund EPF with the approval of the Minister of Finance today declared a dividend rate of 690 per cent for Simpanan Konvensional 2017 with payout amounting to RM4415 billion.

In total the payout for 2017 amounts to RM4813. The main purpose of EPF savings is for ones retirement this savings consists of the EPF contribution by employer and employee. PCB calculator Tax calculator EPF Payroll Sosco and EIS Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022.

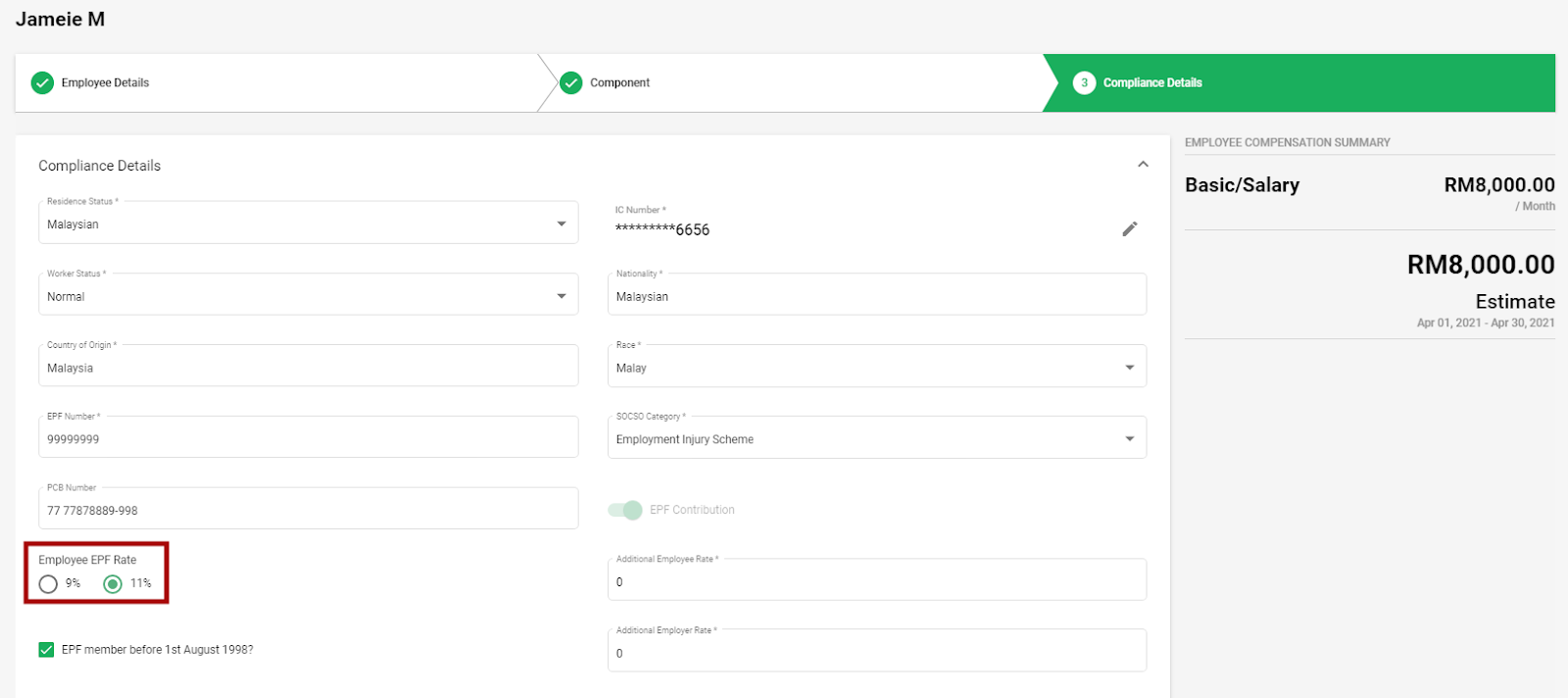

Status Marital Status Tick if applicable Disabled Individual. An example of an Epf Calculator is as follows. Employer at 12 or 13 whereas employee contributes 11 of monthly salary to the EPF.

RM3000 RM500 RM3500. EPF member is eligible. Gain peace of mind as our PCB calculation and EPF contribution rates are updated and accurate as of 2022.

The Simple PCB Calculator is compatible in most popular browsers and mobile devices. KUALA LUMPUR 10 February 2018. Simple PCB Calculator provides quick accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual EPF contribution spouse and children relief.

How is EPF calculated manually. I-Akaun Activation First Time Login. RM 21000 RM 24000 - RM 21000 X 30 RM900.

The standard practice for EPF contribution by employer and employee are. So next in January 2021 EPF members will contribute. Simple PCB Calculator provides quick accurate and easy calculation to Malaysian tax payers to calculate PCB that covers all basic tax relieves such as individual EPF contribution spouse and children relief.

For employees who receive wagessalary exceeding RM5000 the employees contribution of 11 remains while the employers contribution is 12. EPF manage all Malaysian employee savings plan which allow those employees get their retirement fund and retirement plantings. RM 13000-EPF member is not eligible due to the savings in account 1 is less than basic savings.

The below reliefs are what you need to subtract from your income to determine your. In the previous years the statutory employee contribution rate was set at 11 for EPF members under the age of 60. KWSPEPF average yearly interest rate is around 55 per annum so key in 55 Key in how many years in No.

Using the predicted data in the previous calculator input your monthly expenses below for further clarification on how much you would need during retirement and. However that varies according to each members commitments. No guide to income tax will be complete without a list of tax reliefs.

Chargeable income RM54000 Taxable Income RM9000 Individual Tax Relief RM5940 EPF contribution tax relief RM39060. Provident Fund acts as a guarantee for future prosperity or loss of employment and is of great use for future financial decision-making. The EPFs basic savings targets a minimum of RM240000 needed to fund a persons retirement from 55 to 75 years old.

Status Status Perkahwinan Tandakan yang berkenaan Individu Kurang Upaya. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. RM 57000 RM 150000 - RM 57000 X 30 RM27900.

Employees Provident Fund Contribution. If you save RM50000 each month key in RM50000 Key in the expected KWPSEPF Interest Rate Per Annum This is the yearly interest rate of your KWSPEPF for example. Value Of Living Accomodation VOLA Accumulated EPF and Other Approved Funds not exceeding RM6000 per year include life premium insurance Net accumulated remuneration.

EPF also known as KWSP Employee Provident Fund or Kumpulan Wang Simpanan Pekerja is a Malaysia government statutory body under the category of Ministry of Finance. All calculators are provided as is. EPF SOCSO EIS and Income Tax Calculator 2022.

The Employees Provident Funds EPF annual contributions for 2017 rose by 638 per cent to RM6552bil against a total withdrawal of RM4940bil resulting in net inflows of RM16. She would need to pay RM600 on the first RM35000 and 8 on the remaining RM4060 RM32480 which totals to RM92480. Welcome to i-Akaun Employer i-Akaun Employer USER ID.

EPF member is not eligible due to the minimum eligible amount is RM 1000. We are not responsible for any losses or damages resulting from usage of calculatorsPersonal Finance CalculatorsNet Worth CalculatorRetirement CalculatorEstate Planning Calculator. KWSP - EPF contribution rates.

While the 28 tax rate for non-residents is a 3 increase from the previous years 25. Mon Fri 800AM to 600PM Closed on weekends and public holidays. Salary Calculator Malaysia with.

Calculate monthly tax deduction 2022 for Malaysia Tax Residents. RM3500 x 11 percent RM385. Accumulated MTD paid including MTD on.

And 640 per cent for Simpanan Shariah 2017 with payout amounting to RM398 billion. Employees Provident Fund Wages. Employees Provident Fund Contribution.

Technical or management service fees are only liable to tax if the services are rendered in Malaysia. In Malaysiadegree or its equivalent outside Malaysia. Dan sedang belajar sepenuh masa di peringkat diploma ke atas Malaysia atau di peringkat ijazah dan ke atas luar Malaysia d Kurang upaya e.

Free online financial calculators to simplify your personal financesEOE. For employees with monthly wages exceeding RM20000. Her chargeable income would fall under the 35001 50000 bracket.

For Malaysia Residents Non-Residents Returning Expert Program and Knowledge Workers. It aims to be the minimalist alternative to the Official PCB calculator. For each Malaysias employee have to contribute EPF either they are.

RM3500 x 13 percent RM455.

Epf Calculator Online Top Sellers 58 Off Www Ingeniovirtual Com

Malaysia Epf Calculator For Payroll System Smart Touch Technology

Confluence Mobile Support Wiki

Download Epf Unit Trust Calculator Malaysia Apk Free For Android Apktume Com

Epf Calculator Online Top Sellers 58 Off Www Ingeniovirtual Com

Finance Malaysia Blogspot How To Calculate Epf Investment Withdrawal Amount

Download Epf Unit Trust Calculator Malaysia Apk Free For Android Apktume Com

Epf Historical Returns Performance Mypf My

Confluence Mobile Support Wiki

Finance Malaysia Blogspot How To Calculate Epf Investment Withdrawal Amount

Everything You Need To Know About Running Payroll In Malaysia

Epf Calculator 2022 And Epf Contribution In Malaysia

Epf Calculator 2022 And Epf Contribution In Malaysia

Epf Calculator Online Online 60 Off Www Aluviondecascante Com

Epf Calculator Online Top Sellers 58 Off Www Ingeniovirtual Com

Epf Calculator 2022 And Epf Contribution In Malaysia

Confluence Mobile Support Wiki

Time Value Of Money Computing The Retirement Fund In Epf Account Of An Employee Kclau Com